Long-term promise vs current running of economy (IV)

Central banking, (commercial banks) money supply, stock market, inflation

On Wed we wrote that

* 10+ trillion in money supply, in money market accounts being actively drawn

* Money market accounts earning 5+% interest rate

* emergency of AI

* inflation of some discretionary items (outside statistical basket for inflation index)

Recall that on the central bank balance sheet, government bonds on the asset side, backed by future tax revenue, are held against commercial banks reserves on the liability side. Up to a multiplier, the cash is created by commercial banks and flows into the current economy.

Asset. |. Liability

----------------------- | -----------------------------

government bonds. | Commercial bank reserves

mortgage-backed securities |. Misc

So a question arises how to fulfil the long-term promise born by the government bonds, which guarantees today's cash?

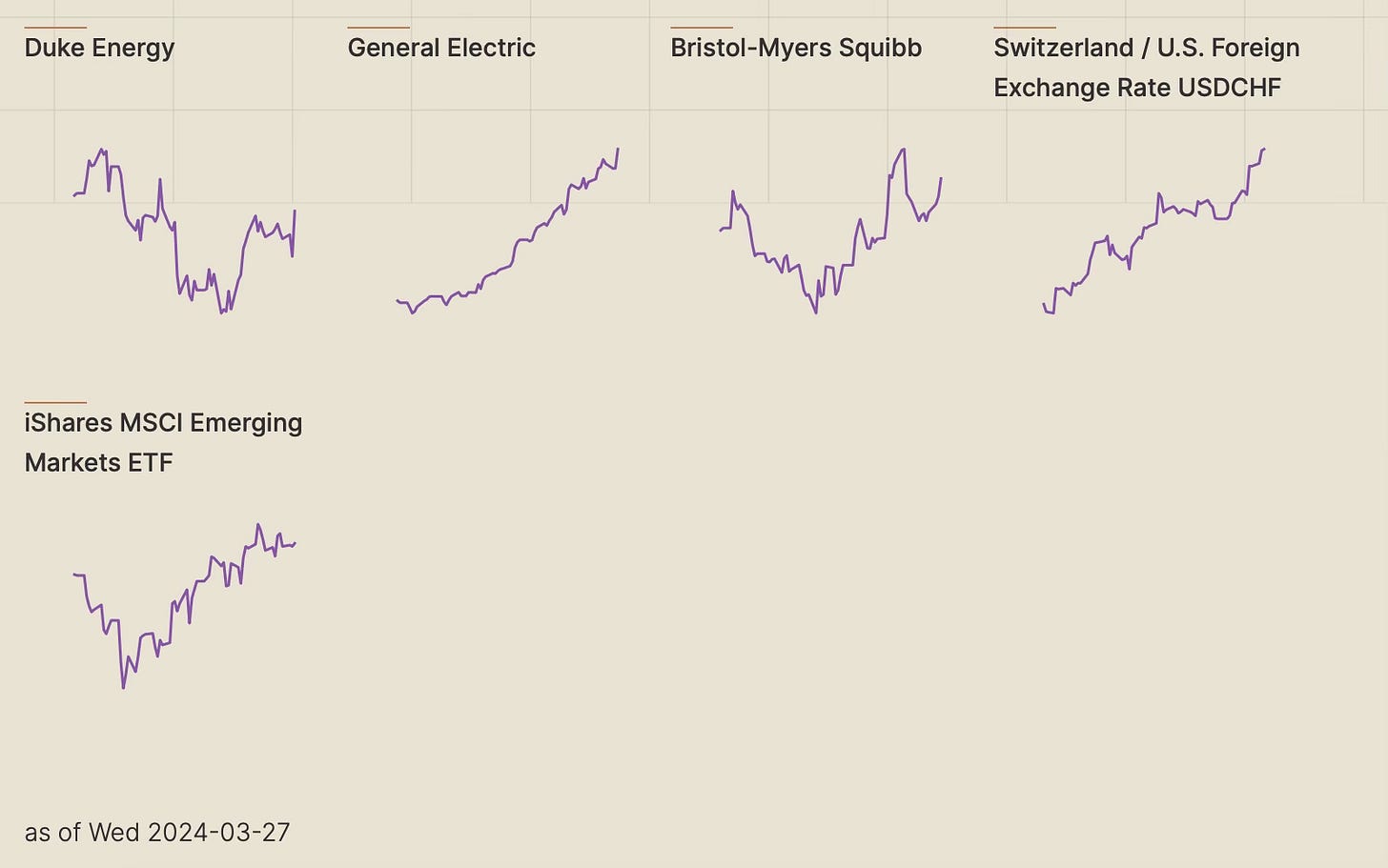

If we search for US treasury nominal yield rates DGS5;DGS10;DGS20;DGS30, the common predictors are computed to be, as of Wed 27 Mar (https://tsterm.com/?q=dgs5%3Bdgs10%3Bdgs20%3Bdgs30&h=24w&asof=2024-03-27):

1. Duke Energy DUK. (energy)

2. General Electric GE (industrial/aviation)

3. Bristol-Myers Squibb BMY (pharmaceutical, linked to inflation)

4. USD/Swiss franc USDCHF (currency)

5. Emerging Markets EEM (China, Korea, India, Mexico, etc)

GE, USDCHF have been rallying since last three months as shown on the screenshot. But if we search for GE and USDCHF on tsterm.com, GE is predicted to go down, USD predicted to depreciate vs Swiss franc CHF, under 6 months outlook. Both could be a risk to the US government bond nominal yield rates.

Hence the last point:

* controlling core inflation

As a summary, how the long-term promise was born and how to fulfil it through current running of economy, as computed today:

* 10+ trillion in money supply, in money market accounts being actively drawn

* Money market accounts earning 5+% interest rate

* emergency of AI

* inflation of some discretionary items (outside statistical basket for inflation index)

* controlling core inflation

The risks to the high US government bond nominal yield rates are, as computed today:

* (new) industry failing to revive

* USD weakening vs store-of-value currencies

* underperforming emerging markets