Long-term promise vs current running of economy

Central banking, (commercial banks) money supply, stock market, inflation

Over past weekend AMZN emerges as computed top predictor for US equity, as well as the Federal Reserve makes pledge for three interest rate cuts in coming time. We look at the whole picture, interpreting the computed results.

The central bank's balance sheet typically looks

Asset. |. Liability

----------------------- | -----------------------------

government bonds. | Commercial bank reserves

mortgage-backed securities |. Misc

the government bonds are usually backed by future tax revenues. After the 07-08 financial crisis, central bank began to take onto balance sheet mortgage-backed securities and credit more commercial bank reserves.

A commercial bank's balance sheet typically has

Asset | Liability

---------------------- | -----------------------------

bank reserves |. investors' equity investment

money supply |. depositors' deposits

loans | savers' savings

misc |

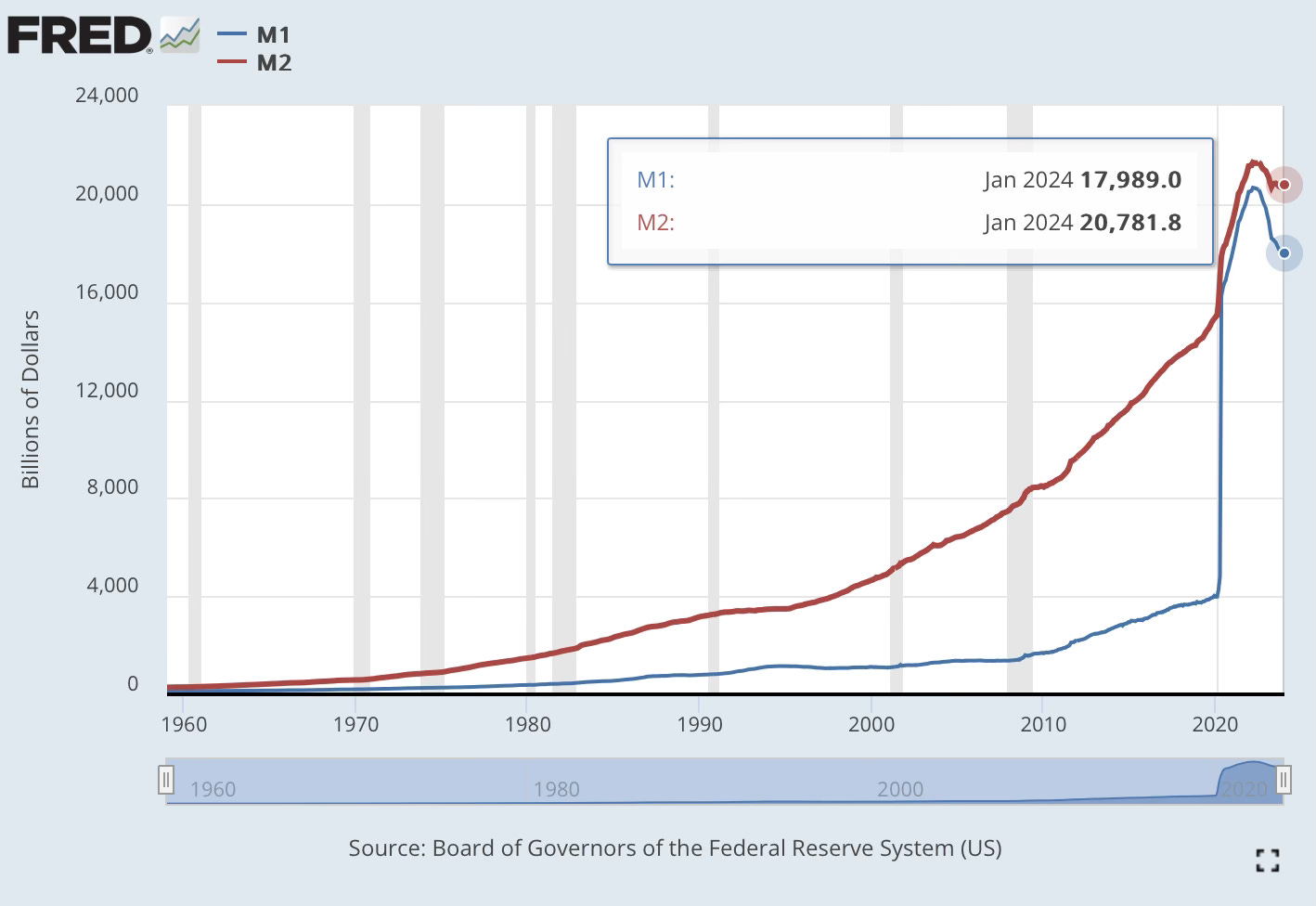

The bank reserves are deposits with the central bank. Commercial banks have to post reserves with the central bank against checkable deposits (cash, possibly earning very low interest rate) but not money market accounts. The checkable deposits are classified as "M1 money supply". If a money market account is withdrawn more than six times per month, that can also get classified as "M1 money supply". Less-frequently withdrawn money market account gets classified as "M2 money supply". (https://fredblog.stlouisfed.org/2021/01/whats-behind-the-recent-surge-in-the-m1-money-supply/)

At the moment the money market accounts earns over 5% annualised interest rate in the US. (https://www.economy.com/united-states/money-market-rate)

Amid pandemic withdrawing of market money accounts become much more frequent so more money base transferred from M2 into M1, but M2 only steadily changed.

Traditionally commercial banks make money from extending loans. But that intermediation activity has been disrupted. Since 1990s commercial banks can also engage in certain investment banking activity as asset-backed securities, but not equities underwriting.