For medium-term asset managers: US financial sector

The white paper on tsterm.com explained the procedure to do synthetic trading, with synthetic position sizes computed from the net majority votes of models, then averaged.

Using 6-month ahead forecast horizon, US financial sector XLF’s latest synthetic position dropped to below 0.2 shares, if it can only vary between -1 share and 1 share.

We’ll look more behind this phenomenon by looking at the constituents of the ETF and checking the synthetic trading performance on some constituent stocks, assuming zero trading cost.

We’ll look at consumer banks JP Morgan JPM, Wells Fargo WFC, and investment banks Goldman Sachs GS, Bank of America BAC, Citigroup C. For JPM, WFC, GS, the synthetic trading was generally long. For BAC, C, lately the synthetic trading could even be short.

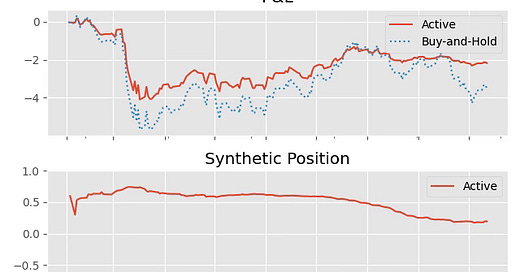

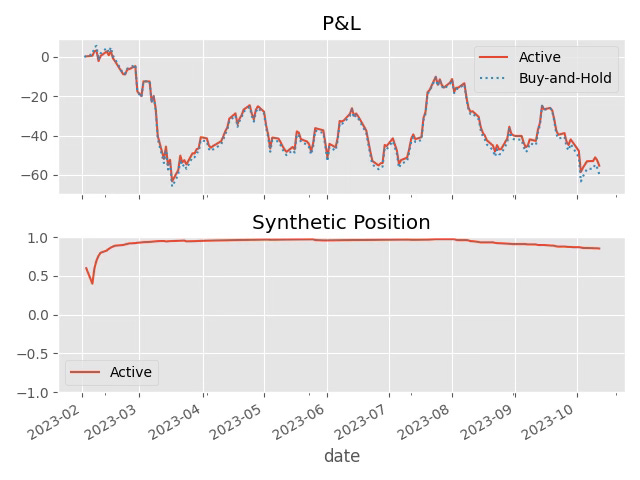

JP Morgan JPM:

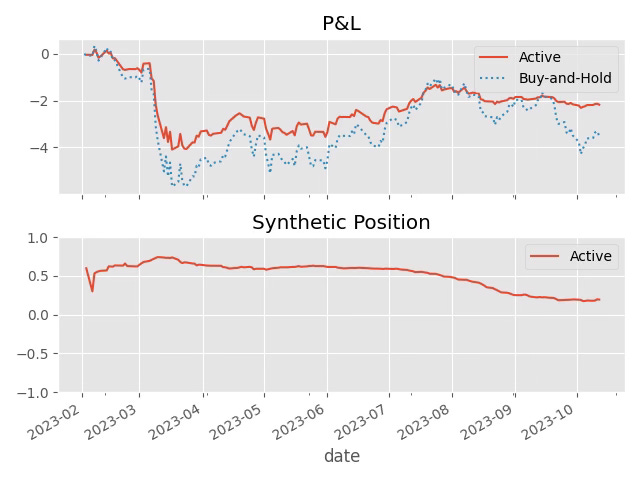

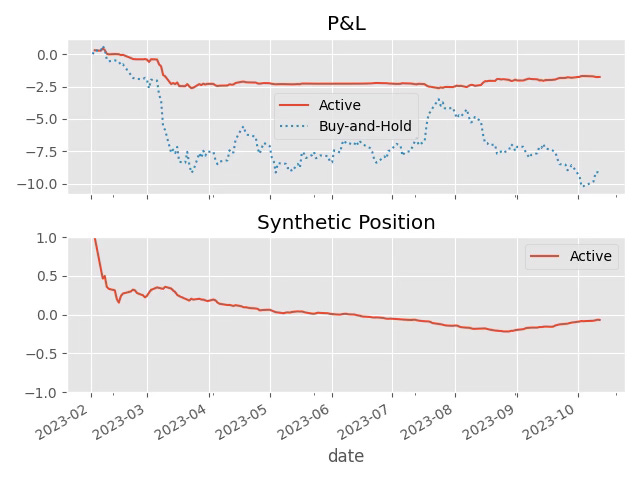

Wells Fargo WFC:

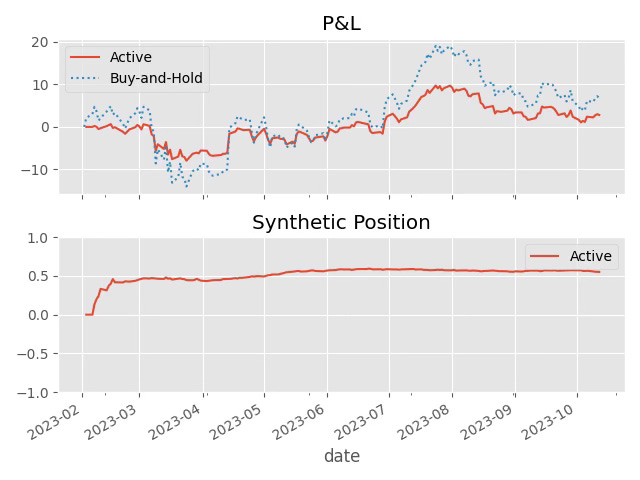

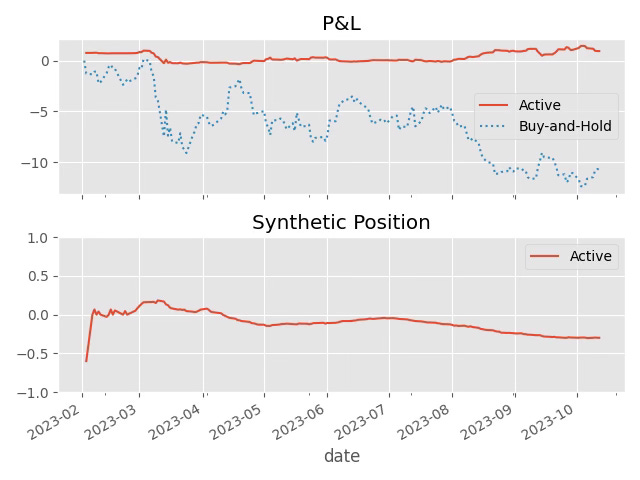

Goldman Sachs GS:

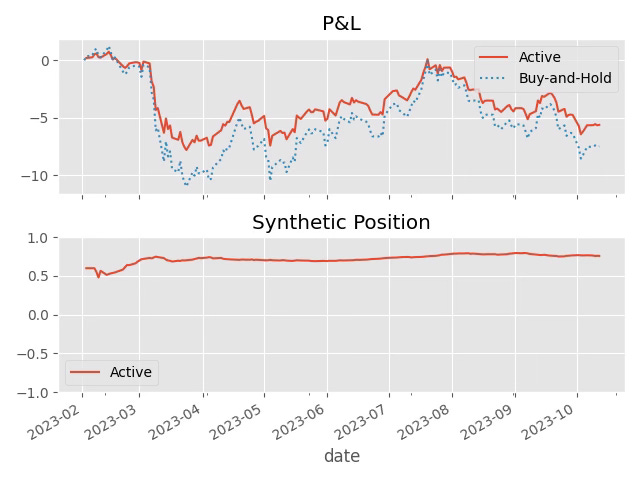

Bank of America BAC:

Citigroup C: