For medium-term asset managers: AAPL and MMM following November Powell talk

As tsterm.com only computes on price data for now for causal inter-temporal predictive relationship, when we write “it happens” below, it was a simple statement that some events took place, without implying that tsterm.com incorporated them into the computation. — The data may have reacted to them, but, it is hard to establish that moving up or down of a figure is due to one particular event and only.

It happened that

Thu 9 Nov, Powell warned against expectation that interest rates will drop once we have a few months of good economic data.

Tue 14 Nov, US inflation data released and dropping

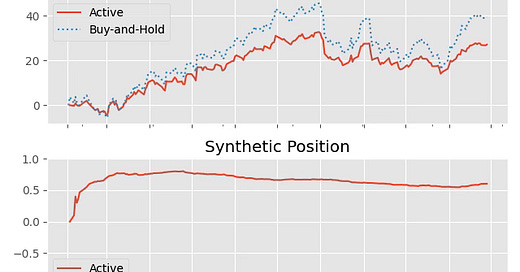

Let’s use 6-month forecast horizon, look at the synthetic positions of AAPL (technology) and MMM (industrial) around the period. The white paper “backtest” section explains why the synthetic position is the average of most recent net predictions, and in the case of 6-month forecast horizon, quite smooth.

The Profit and Loss (P&L) was computed assuming zero trading cost, based on the synthetic positions.

AAPL’s synthetic position shaved off from May till early November, and rebound since Fri 10 Nov from 0.55 to the latest 0.60. An interesting observation is that at the beginning of May vs at the start of November, the AAPL price was about at the same level.

MMM’s synthetic position went all the way down, barely rebound going into November, as computed.

Tomorrow we’ll write about the US equity index ETFs QQQ, SPY and DIA, their behaviour around the period.