Equities at Global Level (I)

Since some time, France equity EWQ is computed to be a top predictor generally under 6-month outlook. This is the first time a non-US asset be computed to drive global assets. Here is a new series on how to understand this. In this introductory post we'll quote two books.

Benjamin Friedman, the Consequences of American Economic Policy Under Reagan and After

After Reagan took office in 1981, US began to de-regulate industries and increase fiscal spending to fund technology research for the defence, which was funded by deficits.

Federal Debt Held by Foreign and International Investors, FRED, https://fred.stlouisfed.org/series/FDHBFIN

US GDP Foreign-held treasuries

1989. 5.64 trillion USD 426 billion USD. (below 10%)

2023 26.6 trillion USD 8 trillion USD (30%)

Up to 1985, as the deficits were expanding, US interest rate rose in order to crush the inflation, in consequence the real interest rate rose, higher than foreign real interest rates, so the USD currency appreciated. In other words, all non-US currencies depreciated, making their exports more competitive. Until 1985 Plaza Accord, by which France, West Germany, Japan, UK and US agreed to coordinate depreciation of the dollar.

Fast forward to 2020, as pandemic hit, the normal channels for foreign banks to hold USD (tourism, trade) were largely cut, the Federal Reserve made international swap lines available to central banks of most western allies. So in the same time, global central bank increased their money supply and the balance sheets increased.

Noel Capon, Marketing of Financial Services

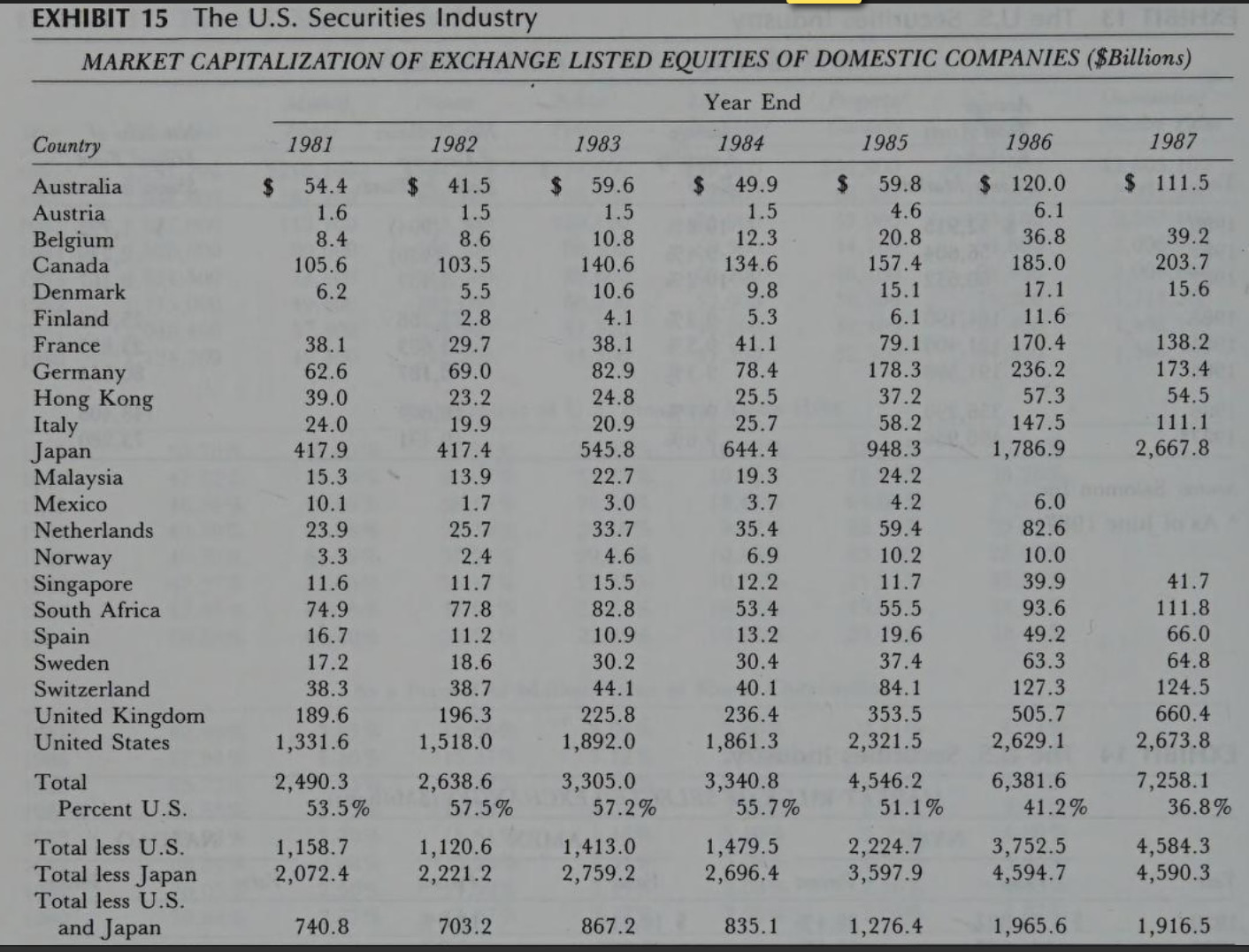

In 1980s, the US equity and equities of Western allies rallied,

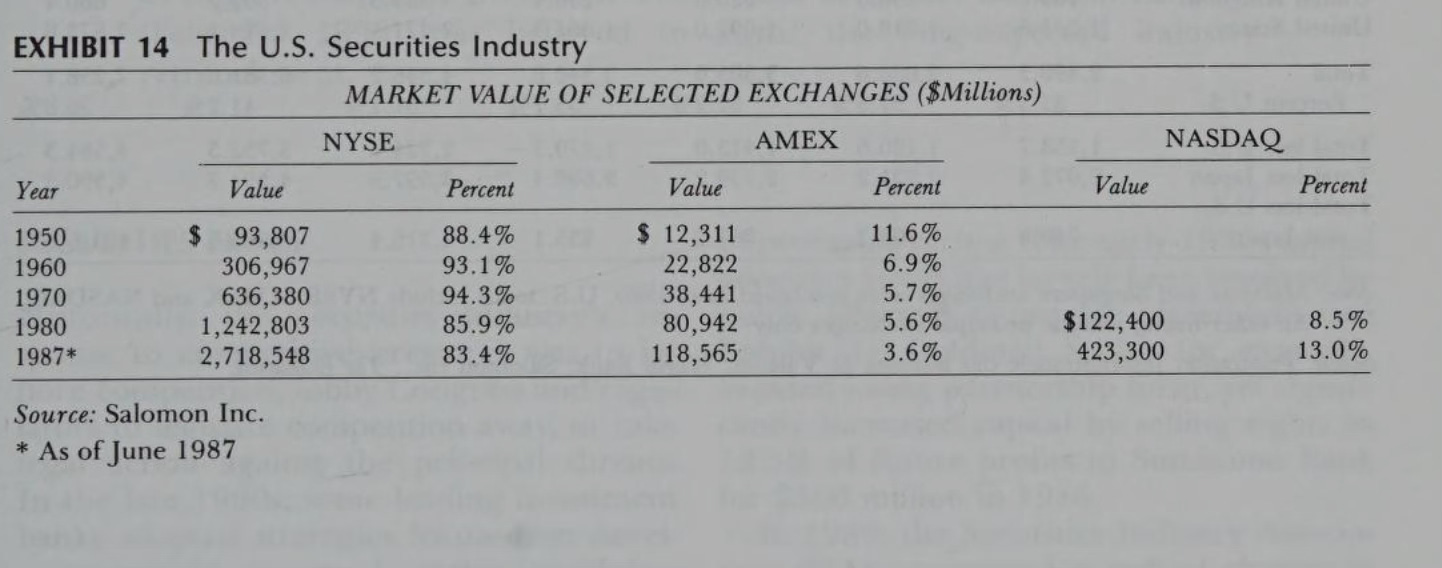

Market value of securities

Japan's equity value multiplied by six times, and reached 2.6 trillion USD by 1987. The other allies roughly doubled in the same period. Ref the table attached. The amounts were denominated in USD. When denominated in respective domestic currencies, the foreign securities' values should have more than doubled.