Amid July 2024 slip: US bonds (and interest rates)

The farther away the maturity is, the less tsterm.com expects the interest rate to drop.

On tsterm.com, if we search for the three US bond ETFs “SHY;IEF;TLT” and scroll down on the result page, we will find model votes for the coming day,

That is, for US 1-3 Year Treasury Bond ETF SHY, 85% models voted “up”, 14% models voted “down”, therefore a majority of 71% models votes “up” for the coming day;

for US 7-10 Year Treasury Bond ETF IEF, a majority of 25% models votes “up” for the coming day;

for US 20+ Year Treasury Bond ETF TLT, a majority of 9% models votes “down” for the coming day.

Bond prices are inversely related to the interest rates, if interest rates go up, the bond price being the sum of the coupons’ values and the principal/face value discounted by the interest rates, will go down; if interest rates go down, the bond price, or the sum of discounted values will go up.

So when the majority of models vote “up” for a bond price, the prediction is “down” for the relevant interest rate; when the majority votes “down” for a bond price, the prediction is “up” for the relevant interest rate.

We see from the prediction results above that the farther away the maturity is, the less tsterm.com expects the interest rate to drop, or equivalently the bond price to increase.

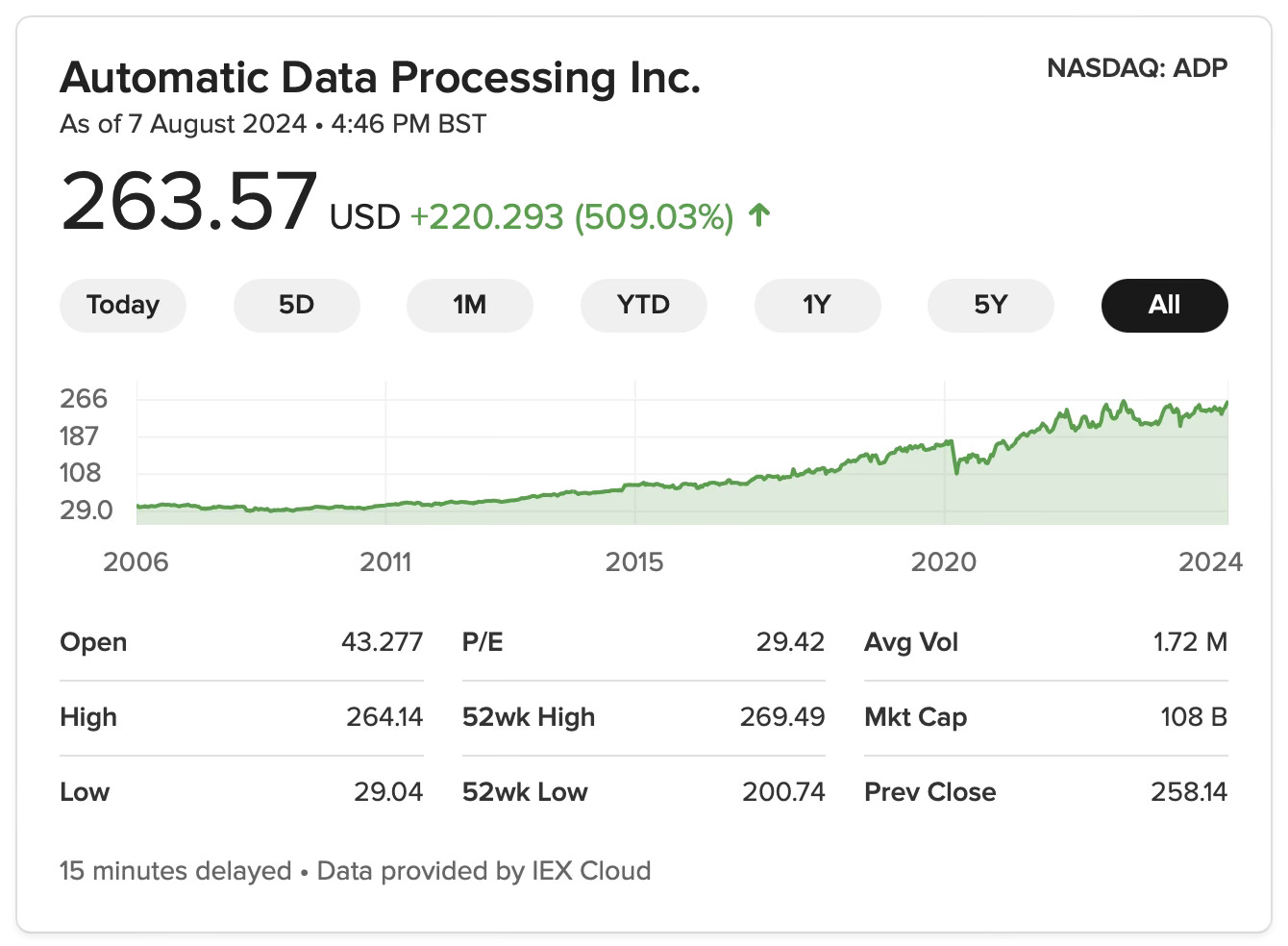

Added after Tue 6 Aug market close: for example, to see why tsterm.com expects the US longest-term interest rate to stay high, search for “TLT” the US 20+ Years Bond ETF. Under 6 month forecast period, the first four causal predictors are stocks generally richly valued (high price-to-earning ratio) but being crushed, ranging across all sectors as industrial, AI, pharmaceutical, and consumer gaming. The fifth is Automatic Data Processing ADP, the leading payroll processing software provider, which may be considered as a symbol for the US Payroll statistic. ADP is about making historic high.