Amid July 2024 slip: GS and JPM

Lowering interest rates from a high level benefit GS business; consumer inflation supports positively JPM.

Goldman Sachs GS

As of Tuesday 30 July market close, most of causal predictors for GS are interest rate related.

No. 1 US 1-3 Year Bond ETF. The US short-term interest rate went down, so the bond price went up.

No. 2 US 10-Year Inflation-Indexed interest rate, or “real” interest rate. This is the interest rate afforded by US 10-Year Treasury Inflation-Protected Securities (TIPS) Bond. According to the TreasuryDirect page on TIPS,

As the name implies, TIPS are set up to protect you against inflation.

Unlike other Treasury securities, where the principal is fixed, the principal of a TIPS can go up or down over its term.

When the TIPS matures, if the principal is higher than the original amount, you get the increased amount. If the principal is equal to or lower than the original amount, you get the original amount.

TIPS pay a fixed rate of interest every six months until they mature. Because we pay interest on the adjusted principal, the amount of interest payment also varies.

The “principal” of a bond is the amount borrowed, that the borrower has to repay at the maturity of the bond. If the principal of the bond increases by the rate of the official inflation rate, at last the effective interest rate paid out on a TIPS bond would the sum of the official inflation rate and the TIPS bond interest rate at each period. That is why the TIPS bond interest rate is called inflation-protected, or real interest rate, as it is the part in excess of the inflation rate.

If one hovers the mouse over the 10-Year real interest rate curve, one can see it has eased from 2.15% at beginning of May to 1.92% at the end of July.

Goldman Sachs’s main revenue comes from investment banking and trading. In 2023, the two largest sources of revenue were fixed income (debt and currencies) intermediation, and equities intermediation. Easing interest rates could prop up valuation of assets, making them more attractive, and reduce cost of borrowing, which is essential for running a banking business.

JP Morgan JPM

As of Tuesday 30 July market close, most of causal predictors for JPM are related to consumer inflation.

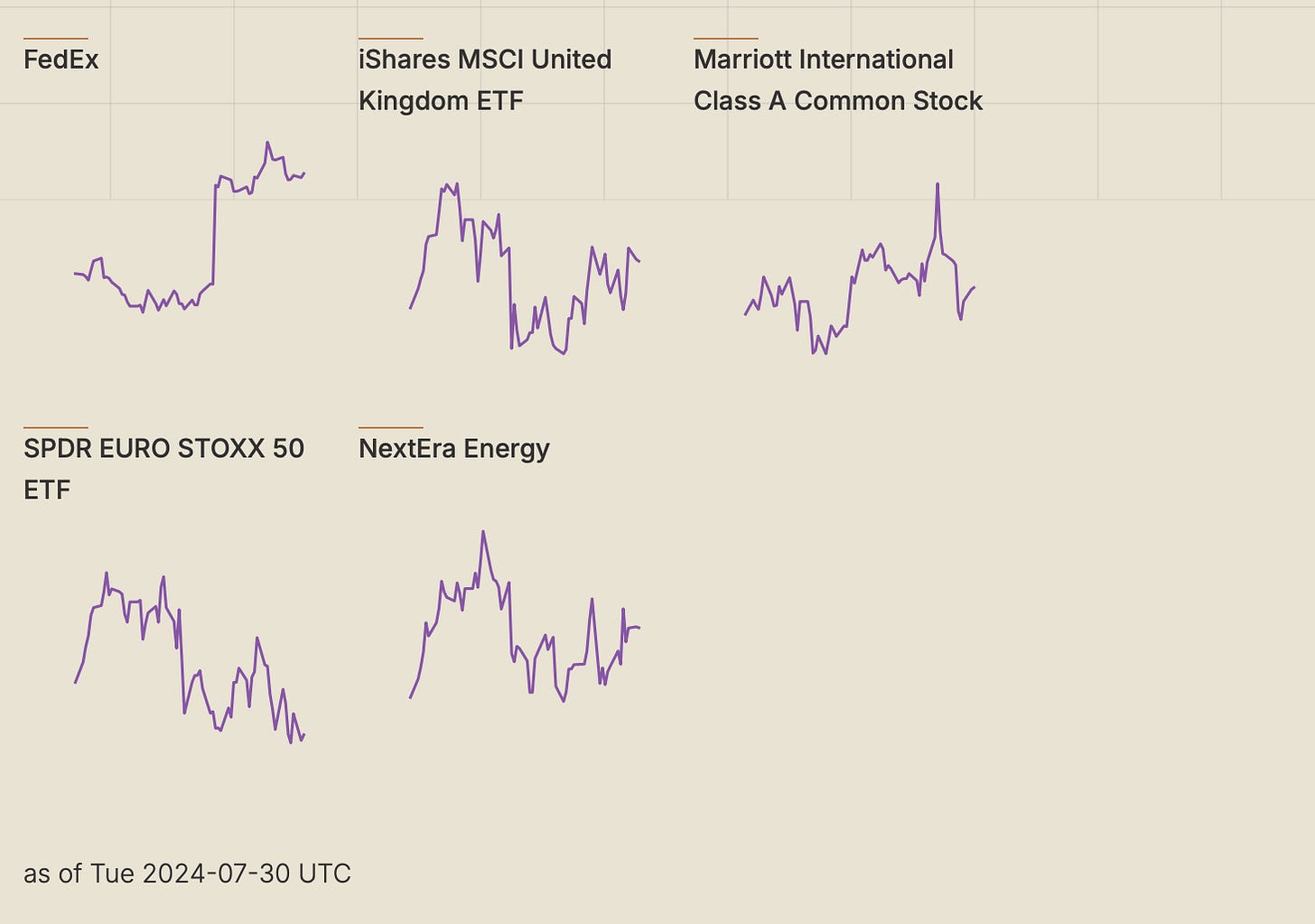

No. 1 Fedex FDX. courrier service

No. 3 Marriott International MAR. international hotel chain

Both can be symbols for consumer inflation.

According to the revenue breakdown of JP Morgan in 2023, 43% of its revenue comes from Consumer and Community Banking. Consumer inflation can be positively linked to deposits and savings with the bank.