Amid July 2024 slip: AMZN considered "investment-grade bond-like"

Unlike AAPL, NVDA, or MSFT, AMZN’s top causal predictor is computed as a US investment-grade bond ETF.

Amazon AMZN

If we search for “Amazon” or “AMZN” on tsterm.com, the top three computed causal predictors are:

US Aggregate Bonds ETF AGG

Expedia EXPE (consumer; travel service)

Liberty Global LBTYK (consumer; telecommunications)

under 6 months forecast period, as of Monday 29 July market close.

The US Aggregate Bonds ETF AGG gives broad exposure to US investment grade bonds. Both EXPE and LBTYK are linked to consumer inflation. Note though AMZN is a technology stock, no technology stock figures among the top 5 computed causal predictors for AMZN.

EXPE: 1 month return +5.60%

1 year return +5.53%

LBTYK: 1 month return. +15.2%

1 year return. +3.95%

In contrast to AAPL, NVDA, MSFT, for which the computed daily positions started to flatten or dip since June or July 2024, the computed daily positions for AMZN continued the rise in the last two months:

The Sharpe ratio for the active trading strategy vs the passive buy-and-hold strategy over one year running record were both 1.29, assuming zero trading cost.

Why the bond ETF AGG is the computed No 1 causal predictor for AMZN?

If when AGG is present, it generally improves prediction performance for AMZN in six months; and when it is absent, the prediction performance generally drops most significantly, then AGG would be considered No 1 causal predictor for AMZN’s value in six months time.

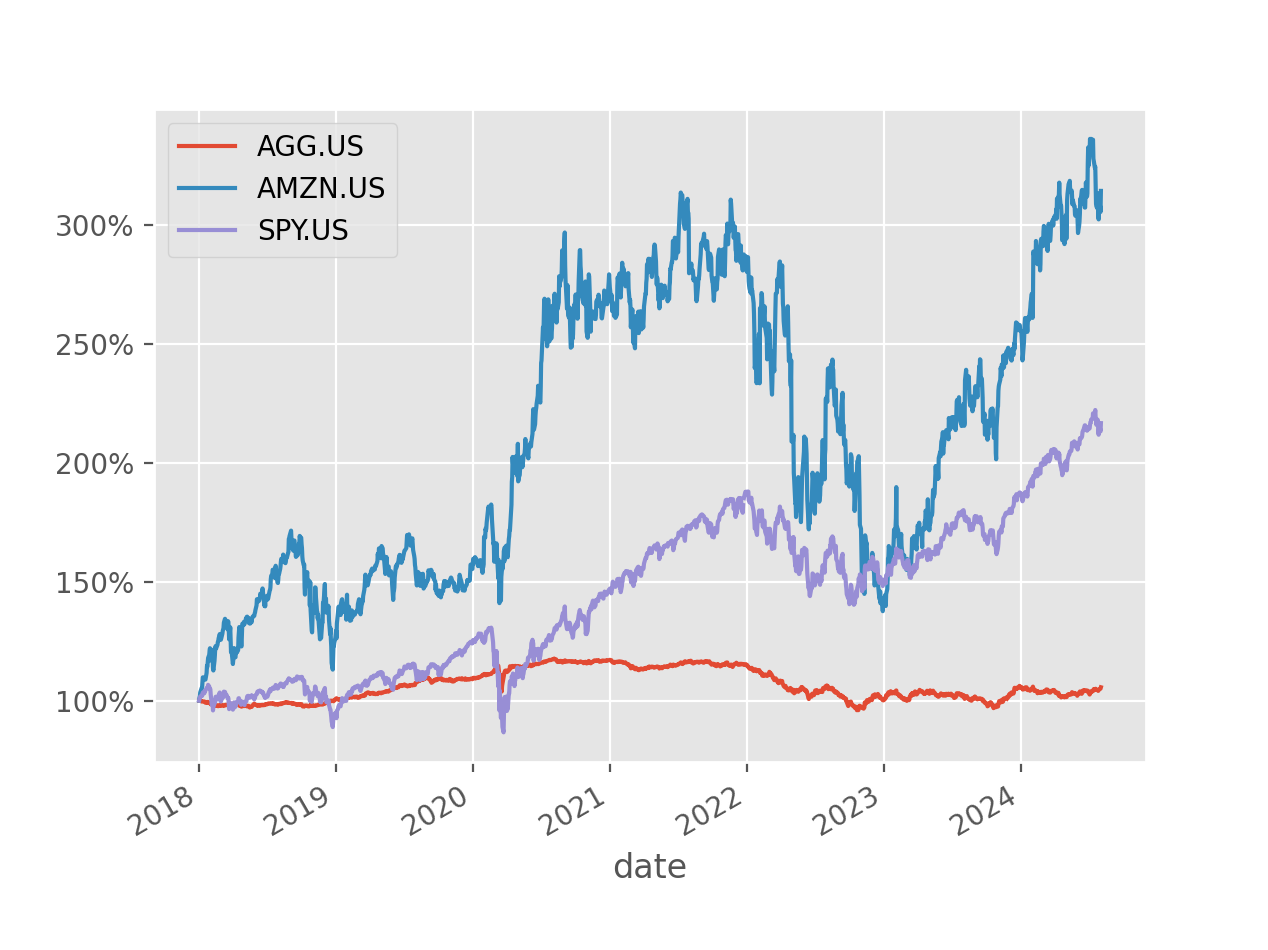

That was a lot of computation behind the scene. On the other hand, if we take a look at AGG, AMZN, and for reference the S&P 500 ETF SPY around the pandemic year 2020 (the three series all normalised with their respective beginning-of-2018 value being 100%), AMZN had reached the high of 300% in the pandemic year 2020 not too far from its latest value in 2024. AGG also reach its high in the pandemic year 2020 as interest rates dived then. From that perspective it was not impossible AGG would be computed as the most significant causal predictor for AMZN six months away.