6-Month Review of Prediction Performance

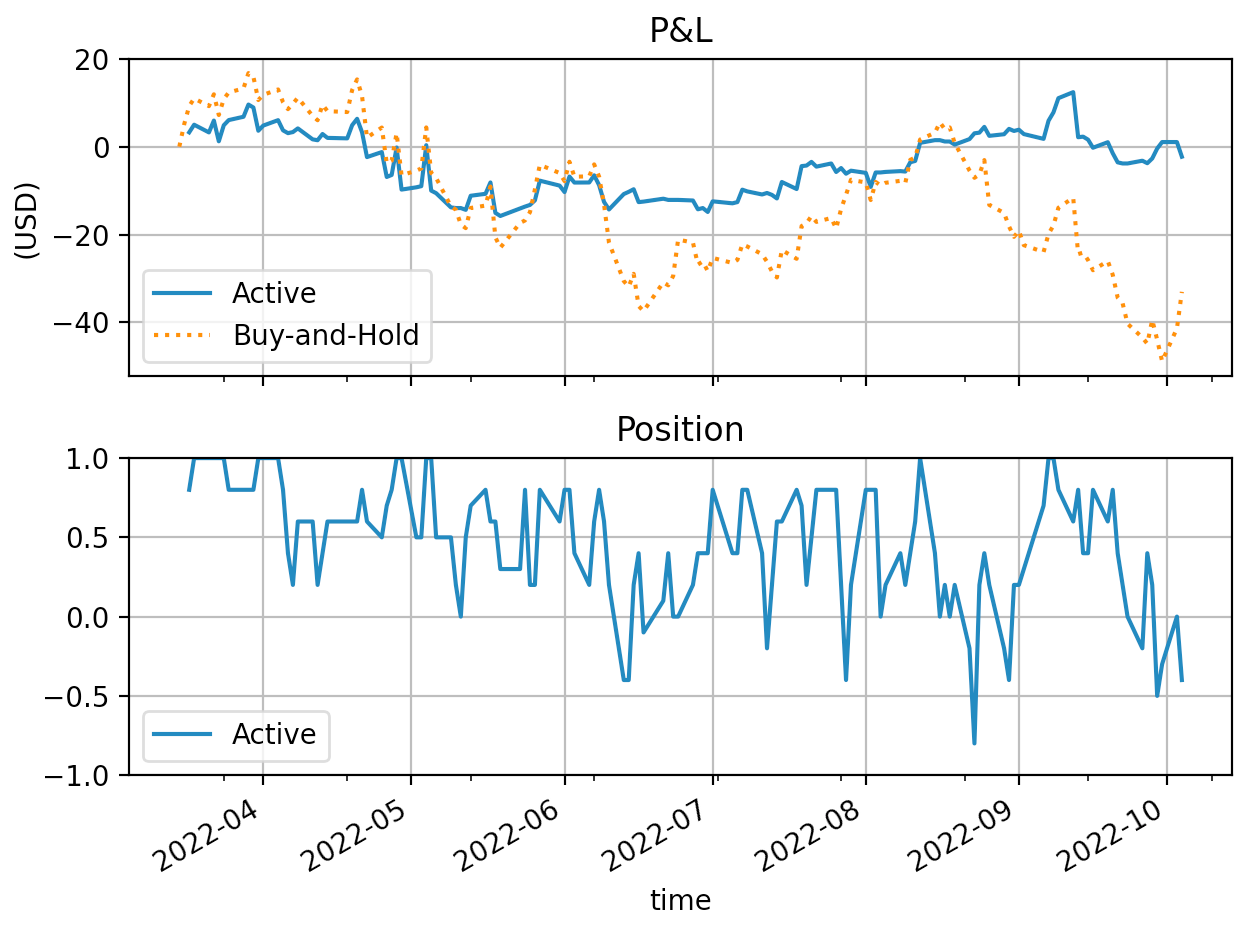

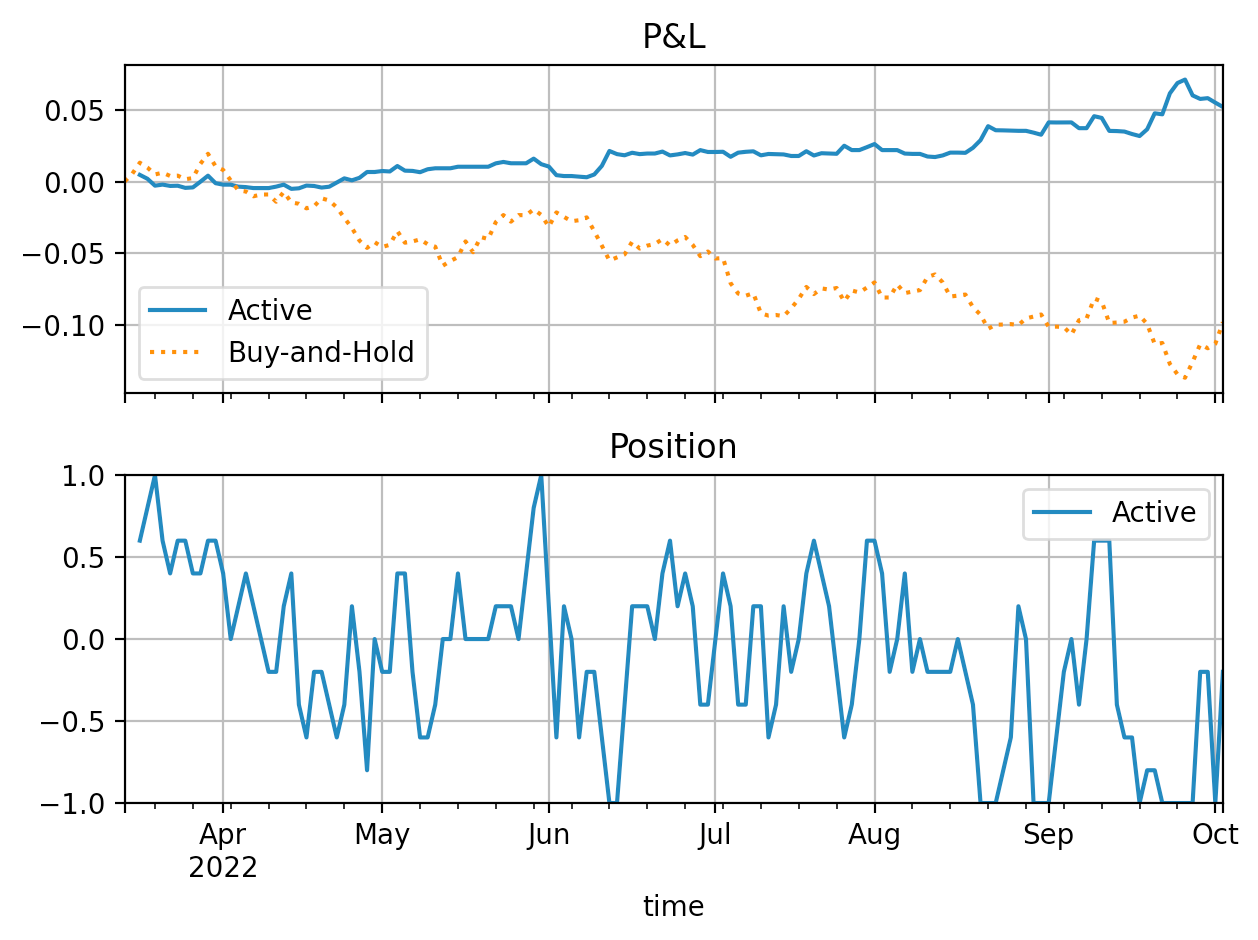

Since the launch in April, from day to day, we compute causal graph for 2-day ahead prediction horizon, make predictions for up to 2 days out, use next-day net prediction to set up hypothetical trading position, which dynamically sizes between -1 and +1 share/lot/unit. On the other hand, the passive strategy would always hold 1 share/lot/unit.

For this paper test, we assume perfect conditions of liquidity and zero trading cost. The main purpose is to showcase the virtue of the approach here from end to end.

Given this setup to manage short-term with 2-day ahead outlook, generally we will see:

For assets that demonstrated clearest long-term trend, the active trading strategy can hardly beat the passive one, but always cuts the maximum drawdown to about half;

For other assets, the predictions have a clear edge;

For meme stocks, cryptocurrencies, and any of those with extreme volatilities, we do not suggest using the engine for predictions.

US Equity

We show results on the Exchange Traded Funds (ETF) for the three major US stock indices.

Nasdaq 100 ETF QQQ

S&P 500 ETF SPY

Dow Jones Industrial Average ETF DIA

Currencies

The value of the currencies are read at 00:00 UTC+0 every day. Alongside we show results on the Gold ETF GLD and Silver ETF SLV.

EURUSD

GBPUSD

Gold ETF GLD

Silver ETF SLV

Commodities

We show results on two US Crude Oil ETF USO and Brent Crude Oil ETF BNO.

US Crude Oil ETF USO

Brent Crude Oil ETF

Lastly, let’s look at the large-cap, growth Apple AAPL. Again, it is very hard to beat. What’s interesting is that as early as September, the computed outlook thus the hypothetical trading position began to turn feeble.

On two consecutive days in September, cryptocurrencies went up 10% and then down 10% around the Ethereum Merge, AAPL also moved violently, but the predicted outlook stayed tampered down, as the predictions are made from AAPL’s driving factors’ information, not AAPL itself.

Apple AAPL