2025-05: Tariff threat, semiconductor driving US equity; semiconductor, utility (inflation) driving Western Europe equity; semiconductor driving US mid-cap equity

As of Thu 29 May market close, tsterm.com identifies causally predictive factors

for the three US stock index ETFs “QQQ.US;SPY.US;DIA.US”,

At the beginning of May we wrote that the Copart CPRT used car auction service floated to the top driving factors just as the US tariff on new automobile parts came into effect. Although it is still computed as No. 1 driving factor, its stock price is lower than before the effect date of tariff on auto parts, maybe expecting these tariffs to be attenuated.

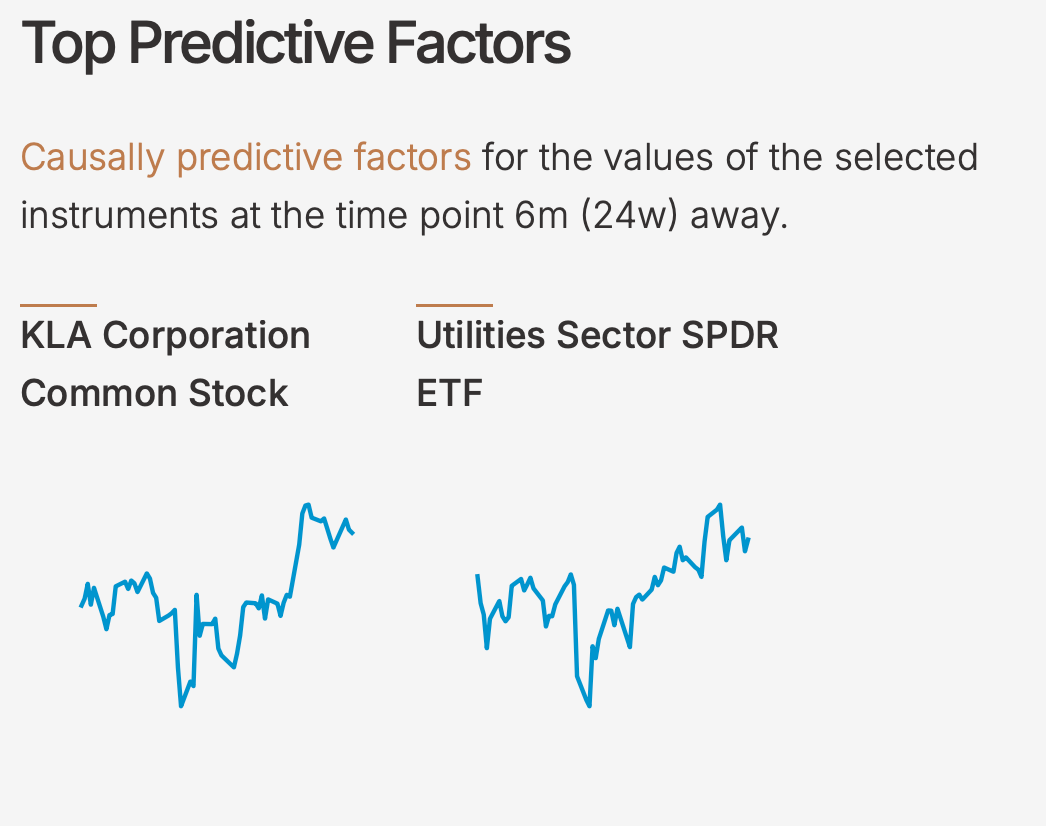

KLA Corporation KLAC produces equipment and software for semiconductor fabrication.

The causally predictive factors for United Kingdom, Germany, France equity ETFs “EWU.US;EWG.US;EWQ.US”,

Note the Utilities Sector SPDR ETF XLU.US is for the US utilities sector as the data sector is US-heavy, but it can still be taken as a symbol for base inflation (for Europe).

The causally predictive factors for US mid-cap ETF MDY.US

Interested readers can search on tsterm.com and scroll down to the bottom of the page to see how the computed daily positions have changed (in the charts “Number of Shares/Lots”).

Support tsterm.com

Would you like predictions for BTCUSD, TSLA.US, etc., and intra-day update for more real-time experience? Support tsterm.com with $5 a month.