2025-01: US 10-Year interest rate, Industrials driving US equity. "DeepSeek" a form of deflation coming from ex-US economy.

US 10-Year interest rate, Industrials driving US equity no more than one week after the Inauguration.

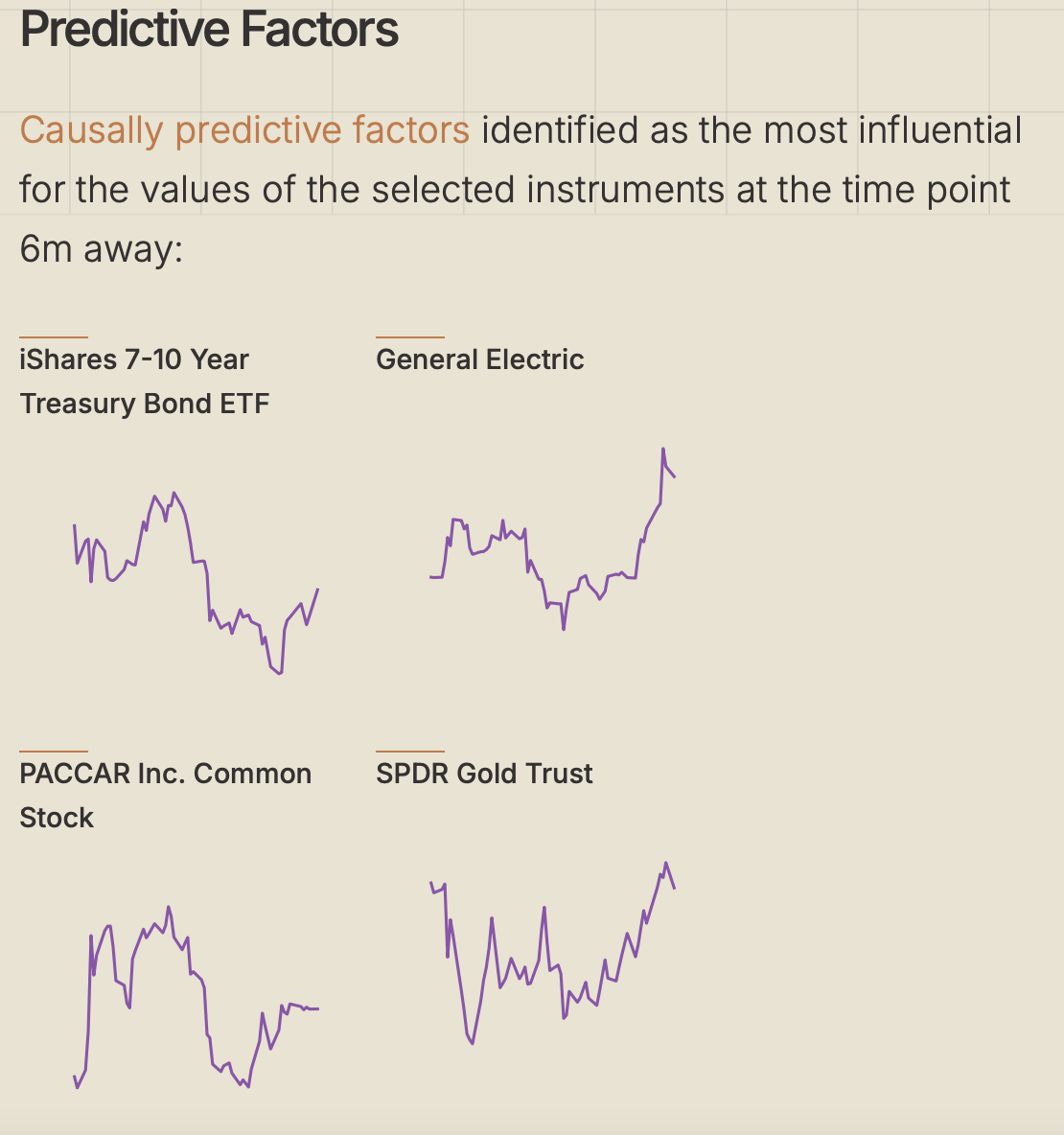

As of Monday 27 January market close, the top driving factors for the three major US stock indices as below. More precisely, they are computed as the top causal predictors for their values on the day six months away from Monday 27 January. Note GE is GE Aerospace as they spun away other businesses.

https://tsterm.com/?q=QQQ.US%3BSPY.US%3BDIA.US&

Both IEF.US and TLT.US (treasury bond ETF) driving factors include Chinese currencies, and the daily position on the bond is going up. So bond price envisioned to go up, interest rate envisioned to go down.

So it may be interpreted as: when USD get strong vs other currencies, there’ll be deflationary pressure coming from those other economies. “DeepSeek” was an economic story of “go cheaper”.

IEF.US 7-10 year US bond ETF https://tsterm.com/?q=ief

TLT.US 20+ year US bond ETF https://tsterm.com/?q=tlt