2024-08: stocks producing daily essentials (consumer/energy), biotechnology, industrial top causal predictors for S&P 500; DuPont to split into three companies

S&P 500

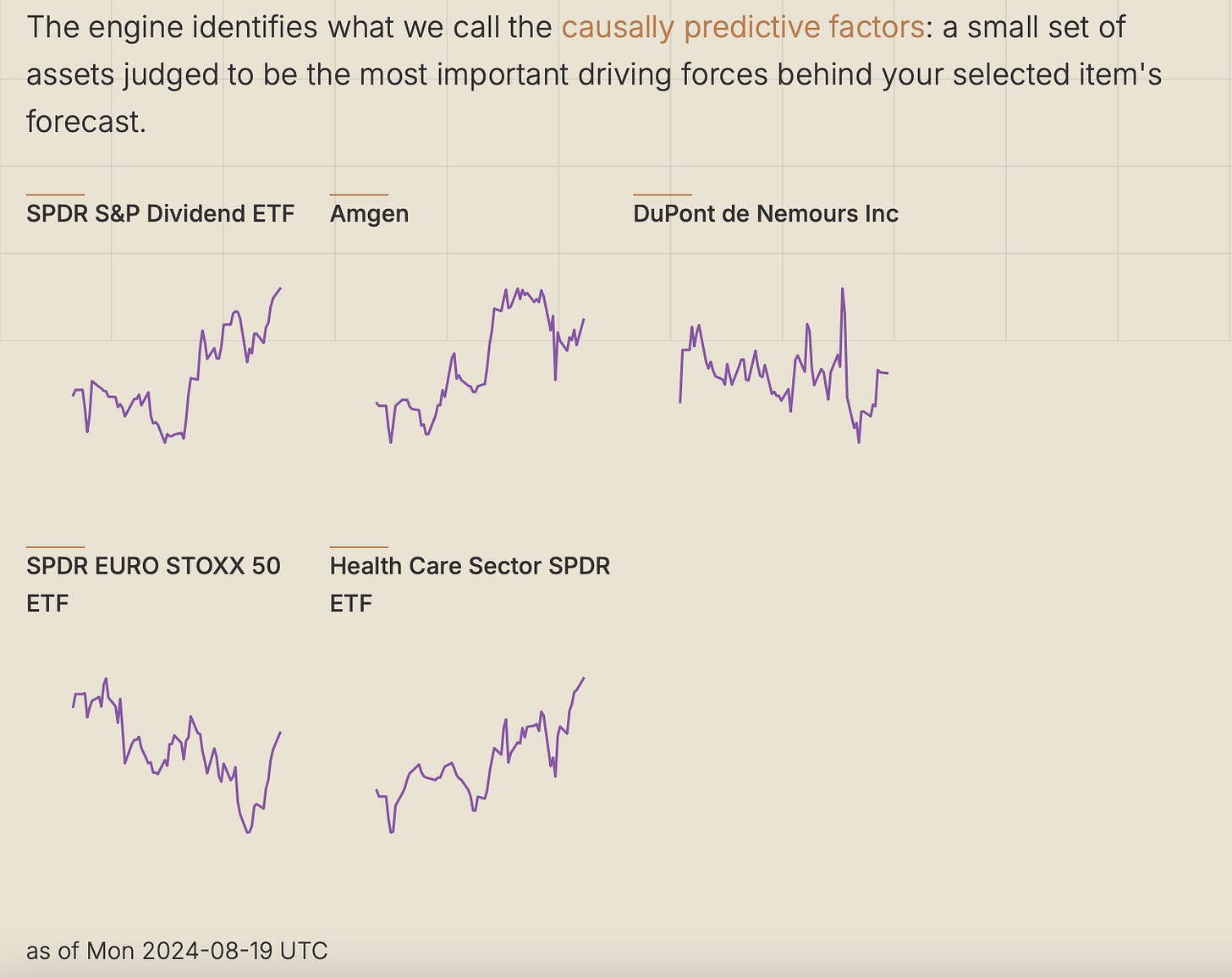

As of Monday 19 August close, the top three causal predictors for the S&P 500 ETF SPY are computed as (https://tsterm.com/?q=SPY.US&)

SPDR S&P Dividend ETF SPY (a basket of stocks from consumer, energy to business machines)

Amgen AMGN (biotechnology)

DuPont de Nemours DD (industrial)

for 6 months forecast period (ie. we are interested in predicting the probabilistic distribution of the value on the day in 6 months from the Monday 19 August).

Both SPY and AMGN went slightly up in the same period amid slight ease of the treasury interest rates. DD was fluctuating in the last three months,

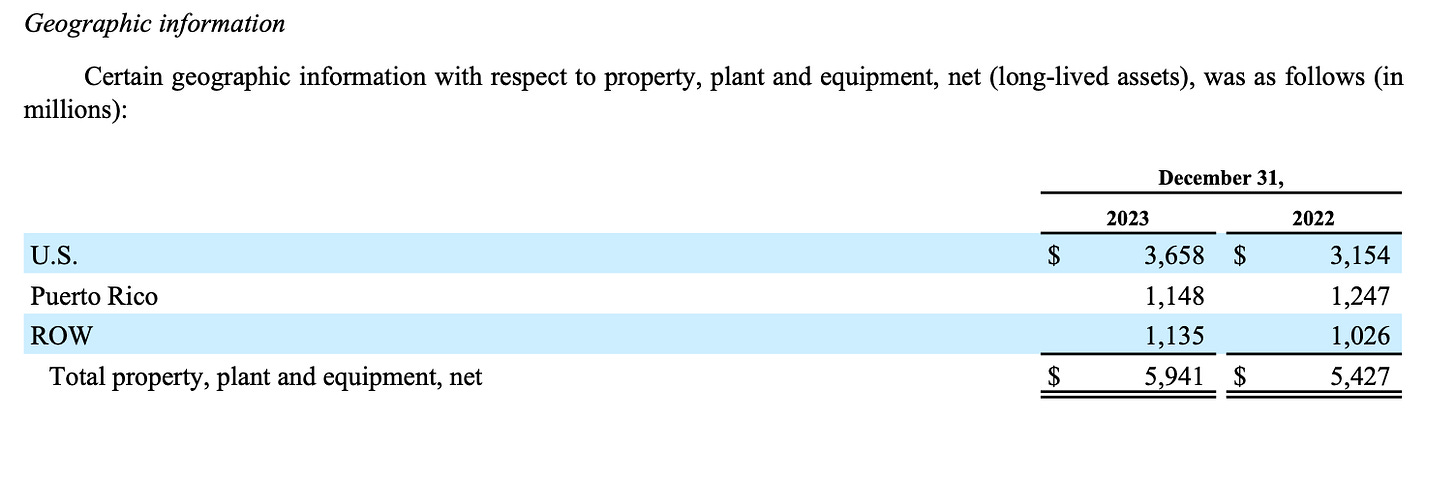

According to AMGN 2023 Annual Report, AMGN places 80% asset in the US and Puerto Rico (Notes to Financial Statements, 12. Property plant and equipment, page F-33), and 72% of revenue comes from the US, 28% from the Rest of World (Notes to Financial Statements, 4. Revenues, page F-20).

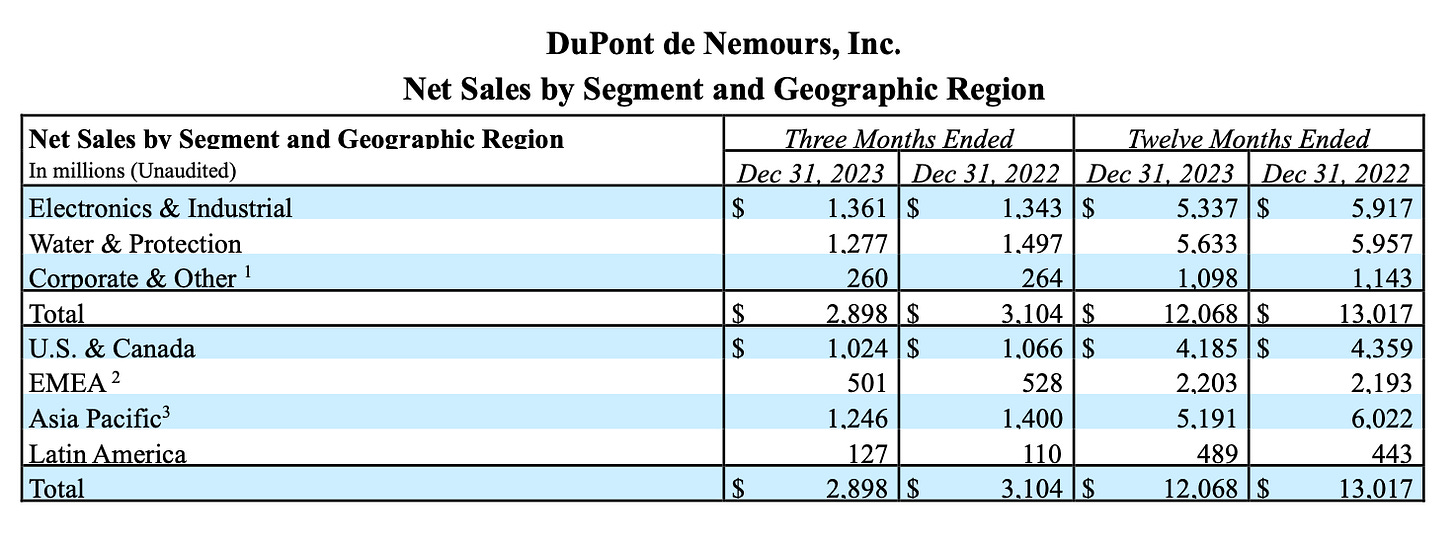

According to DD 2023 Annual Report, on page 14, in 2023 the US & Canada accounted for 34% of total net sales, the Rest of World 66%. However the net sales in both the “Electronics & Industrial” and “Water & Protection” departments declined.

On May 22, DuPont made announcement that it is going to split into three companies: Electronics & Industrial, Water & Protection, and the remaining industrial business “to pursue their own focused growth strategies”.

Bank of Japan July Interest Rate Raise

At the end of July, the Bank of Japan lifted its benchmark interest rate to 0.25 per cent.

According to the same Reuters report, The bank in March ended its negative interest rate policy following decades of on-and-off deflation.

USD began to depreciate vs JPY since the beginning of July. On tsterm.com (https://tsterm.com/?q=jpy), for 6 months forecast period, the daily position of USD would have steadily decreased since as early as June, to swap into JPY by a marginal extent.

Under this forecast period, each day the models vote “up” “down” for the USDJPY’s value six months away, a trade would be opened and held for six months with a position size proportional to the majority vote. The daily position would be the average of positions of active trades (opened over recent six months). Being averaged over so many items, that’s why the daily position appears smooth.