2024-06: Performance of past simulated trades online; Risks from Western Europe worth watching for US equity

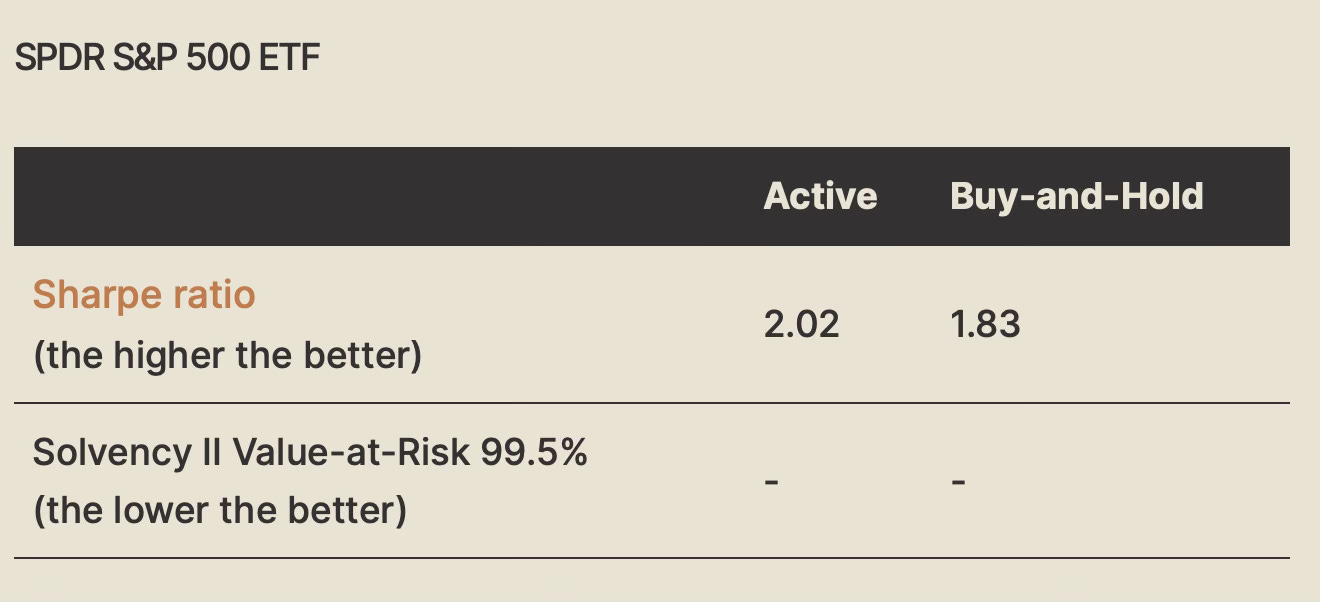

We have put performance of past simulated trades online. The Sharpe ratio is calculated on returns measured as the difference between values rather than in percentage, assuming zero trading cost.

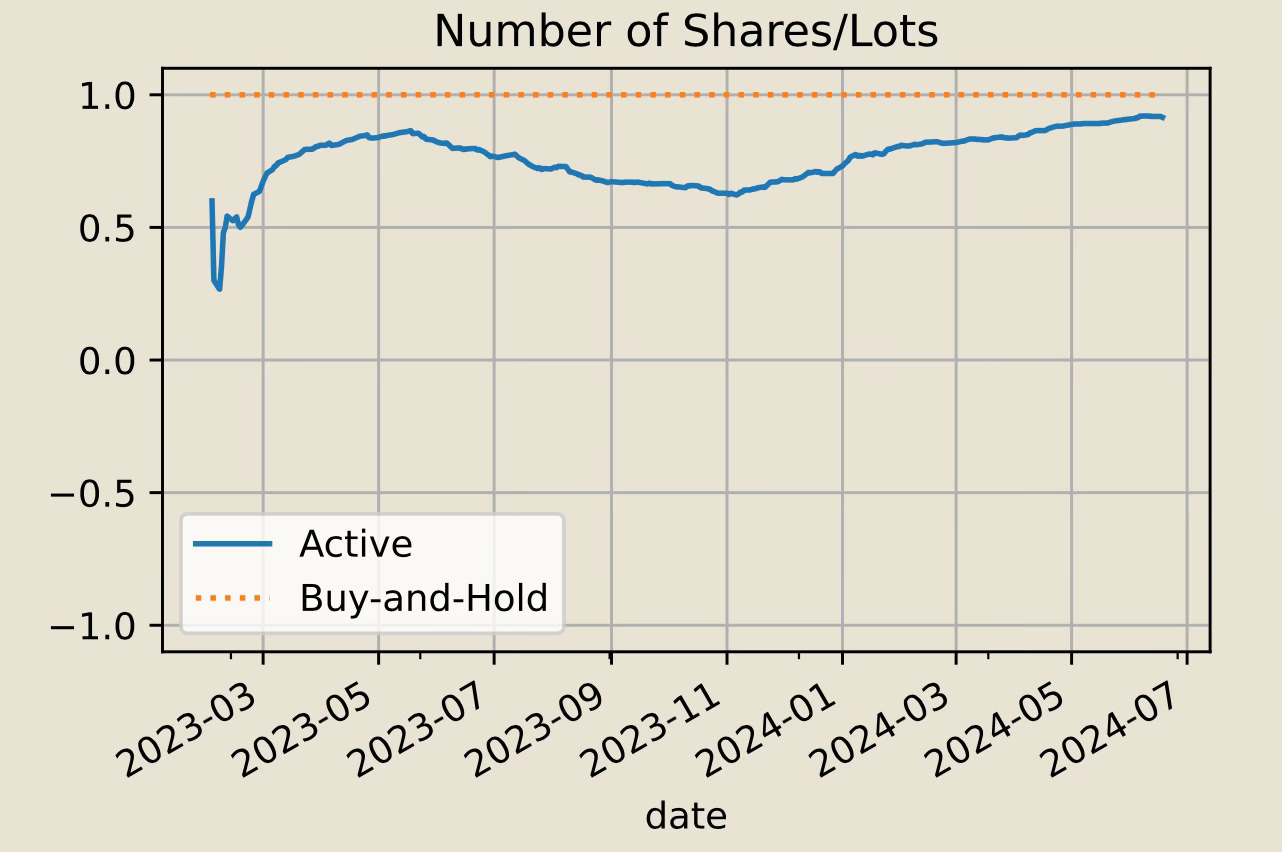

For example, S&P 500 ETF SPY under 6 months outlook https://tsterm.com/?q=spy

The position steadily picked up since Nov 2023, slightly preceding when the Fed signalled no more hike of interest rate

As of Friday 21 June 2024 close, Western Europe Euro STOXX 50 ETF FEZ was computed as the top causal predictor for US equity index ETFs QQQ, SPY, DIA 6 months out. https://tsterm.com/?q=QQQ.US%3BSPY.US%3BDIA.US&

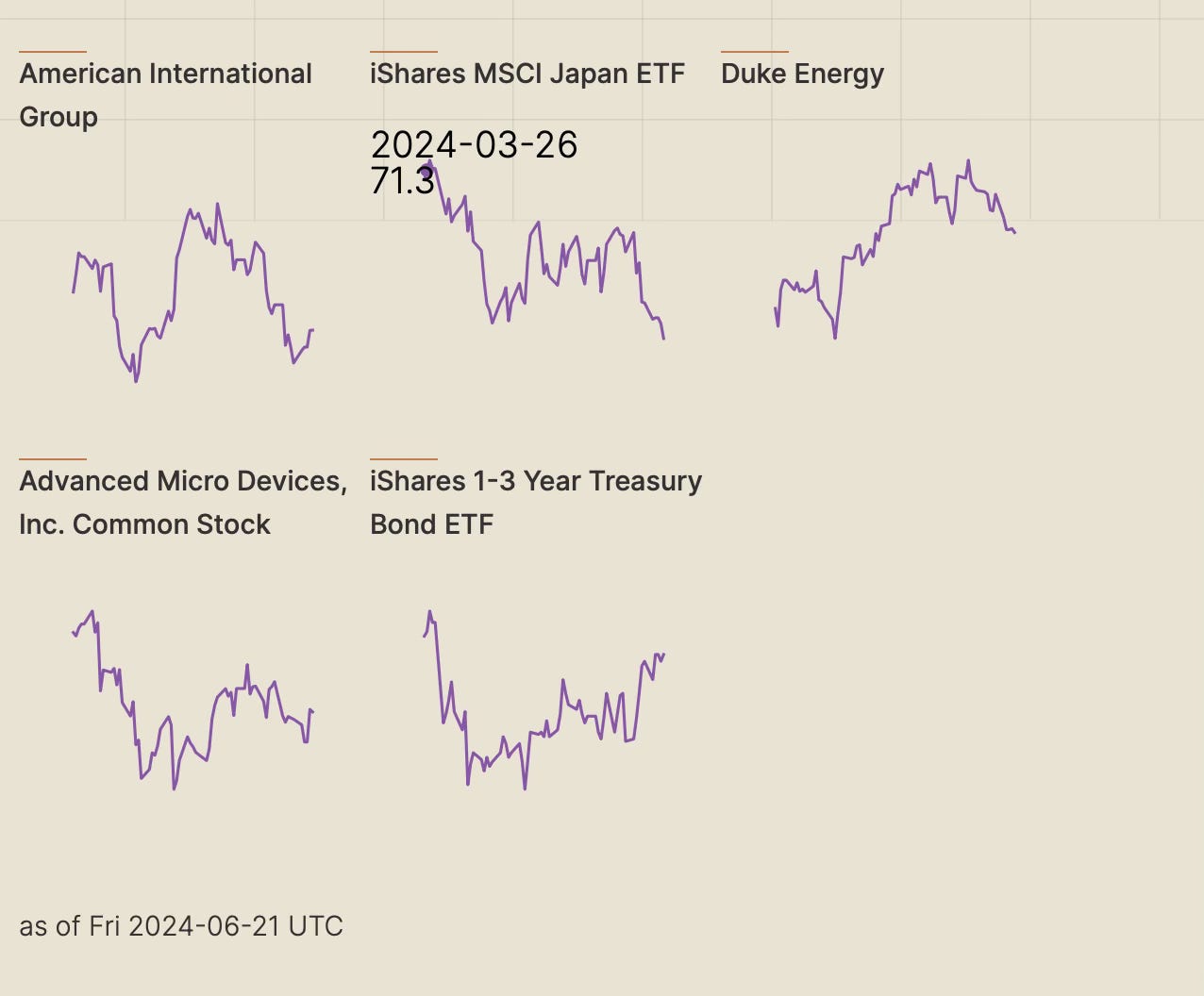

The Euro STOXX 50 ETF FEZ dipped since last week. If we search for FEZ on tsterm.com, https://tsterm.com/?q=fez, the top two driving factors for FEZ are linked to decreasing US interest rates and the Japanese equity (denominated in USD) topping out since the end of March,

There may also be political risk such as France calling for snap election to be held on 30 June and 7 July.

From the tsterm.com page for US equity indices https://tsterm.com/?q=QQQ.US%3BSPY.US%3BDIA.US& the next-day net prediction (used directly as trading position) for the Nasdaq 100 ETF QQQ dipped one percentage point since one week; the next-day net prediction for the S&P 500 ETF SPY flattened. So according to tsterm.com, risks from Europe could impact in first instance the Nasdaq 100 index, one for innovation albeit with high valuation (high price-to-earning ratio).