2024-01: AI stocks and consumer as drivers (predictors) for US equity 6 months out

According to tsterm.com, using 6-month ahead forecast period,

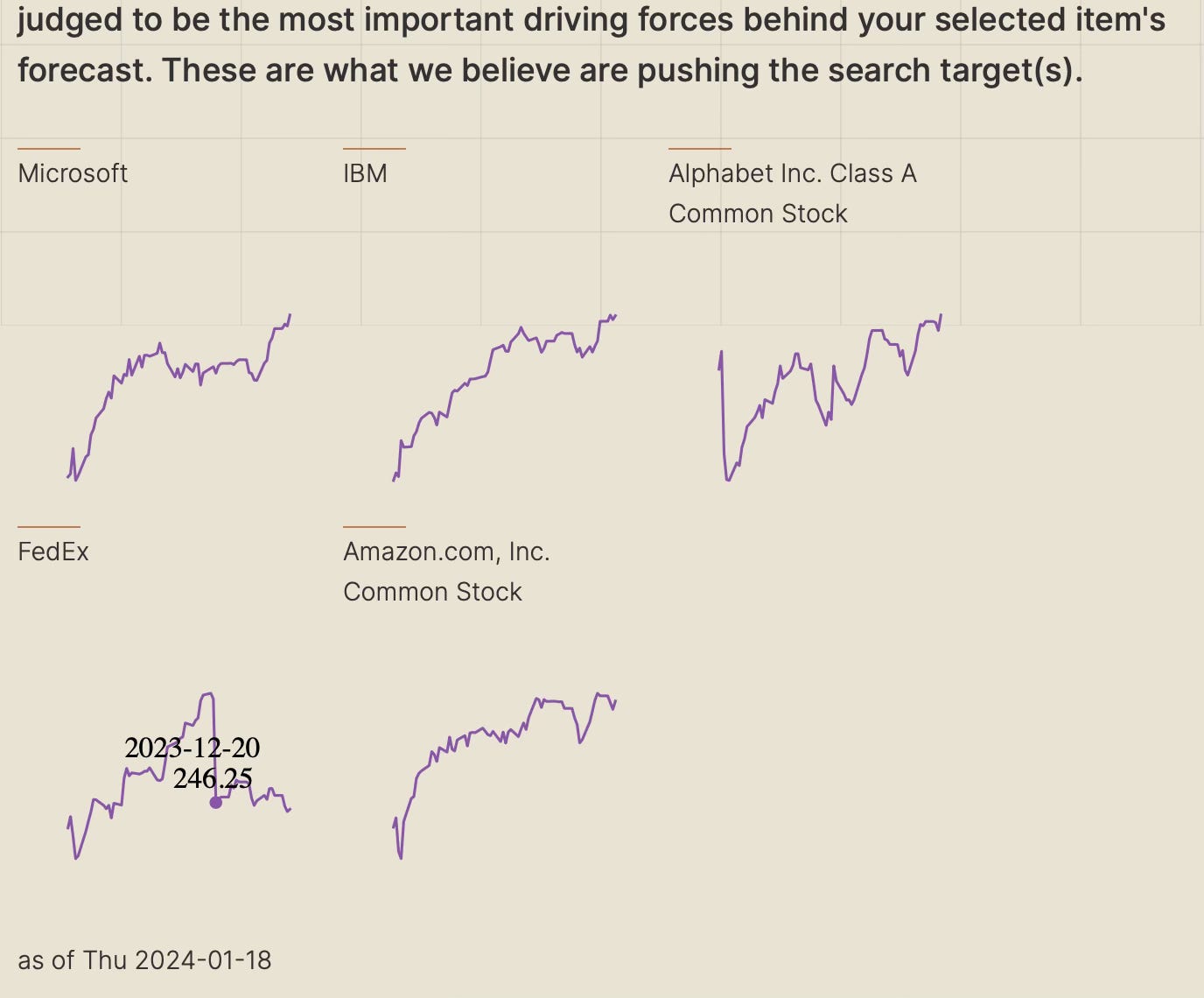

if one searches for QQQ.US;SPY.US;DIA.US, the three US equity index ETFs, as of Thu 18 Jan 2024 market close, the common causal predictors are computed to be

Microsoft MSFT (tech, major partner with OpenAI, which makes ChatGPT)

IBM (blue-chip tech, with recent news working on AI)

Alphabet GOOGL (tech, AI)

Fedex FDX (consumer, postal service)

Amazon AMZN (tech, AI)

aka, these predictors’ current values are computed to be influential for the values (settlement price) of QQQ SPY DIA on 18 July 2024, which falls on 6 months away from 18 Jan 2024.

As the Federal Reserve let news out to stop increasing the interest rate, US stocks rallied since last December. We may note the Fedex FDX got promptly sold off some on Wed 2023-12-20.

If we list the current price-to-earning ratios of the above five predictors,

MSFT 38

IBM 22

GOOGL. 29

FDX 14

AMZN. 79

Historically, the median level of price-to-earning ratio of the S&P 500 index was around 14-18 depending on the calculation period (https://www.multpl.com/s-p-500-pe-ratio). So we see in the above five computed predictors, the growth aspect is only in the AI-related tech stocks, the market affecting them higher valuations.