18-Month Review of Prediction Performance

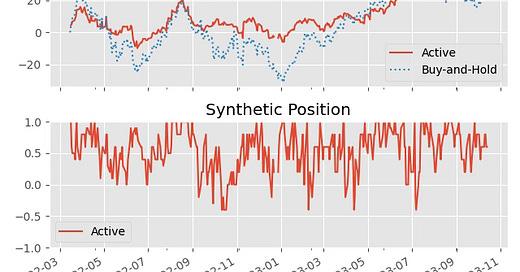

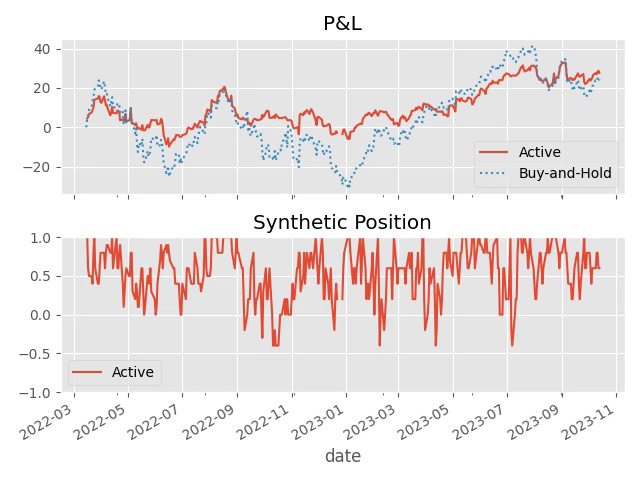

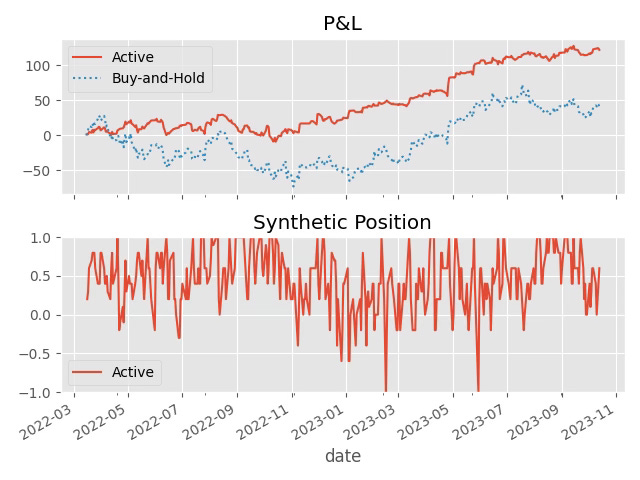

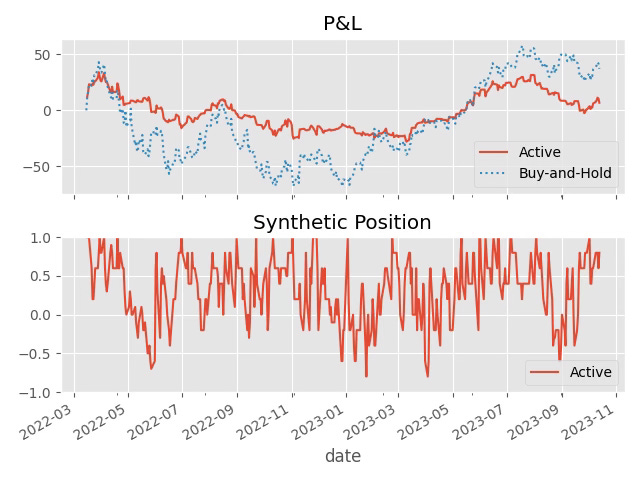

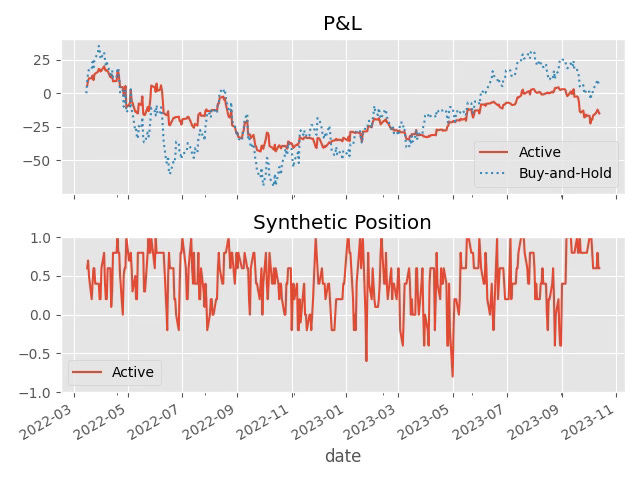

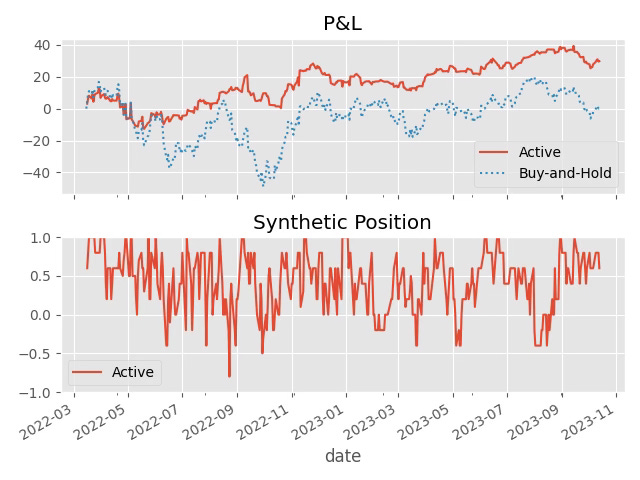

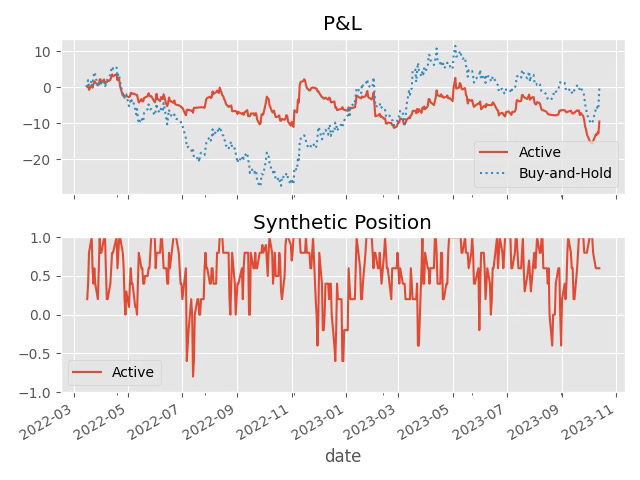

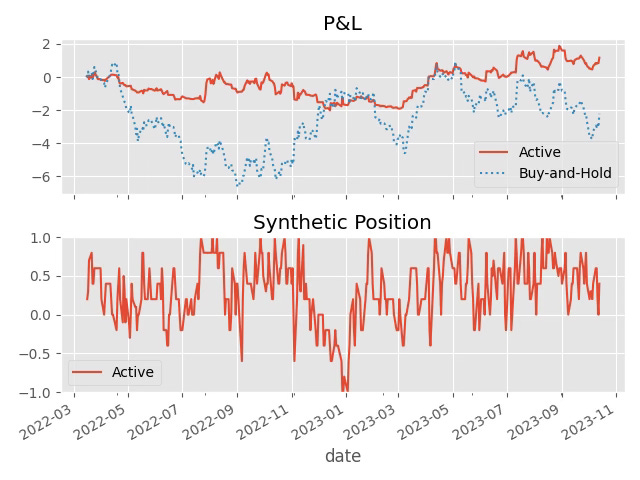

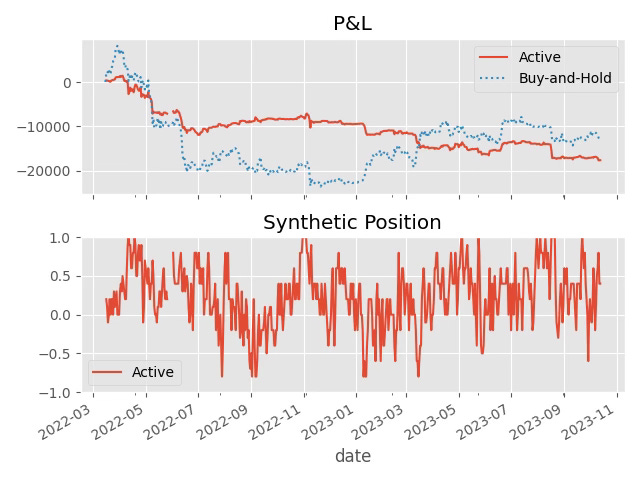

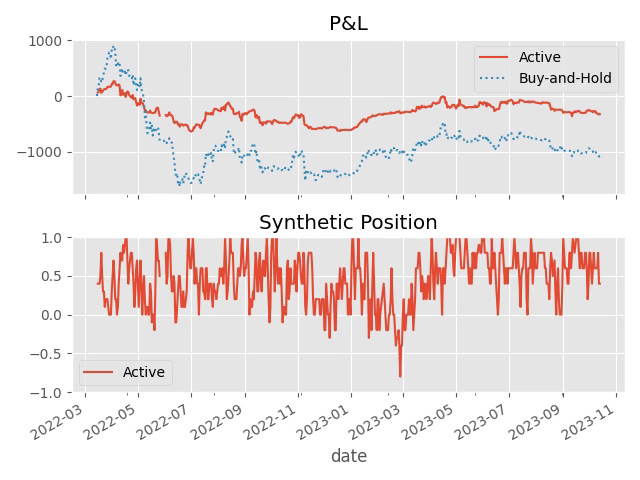

We use the short horizon “2-day ahead”, and the net predictions over the past 18 months, to perform synthetic trading backtest. For how to work out the synthetic positions for each day, refer to the white paper “Backtest” section.

Settings:

The model trainings from daily data

assume zero synthetic trading cost

The active strategy synthetic trading position size is an average of the most recent net majority votes of models, which can vary between -1 share and 1 share, inclusively; the buy-and-hold strategy always holds 1 share of the instrument

Consistent with the “1-Year Review of Prediction Performance”, we found that under the above settings,

US Nasdaq 100, S&P 500 indices were hard for the active strategy to beat the buy-and-hold strategy

Gold was hard for the active strategy to beat the buy-and-hold strategy

Bitcoin was hard for the active strategy to beat the buy-and-hold strategy

Below are the charts of synthetic trading profit and loss for both the active and buy-and-hold strategies, and synthetic trading position sizes for the active strategy.

Apple AAPL

Microsoft MSFT

Nasdaq 100 ETF QQQ

S&P 500 ETF SPY

Dow Jones Industrial Average ETF DIA

Gold ETF GLD

Silver ETF SLV

Bitcoin BTC/USDT

Ethereum ETH/USDT